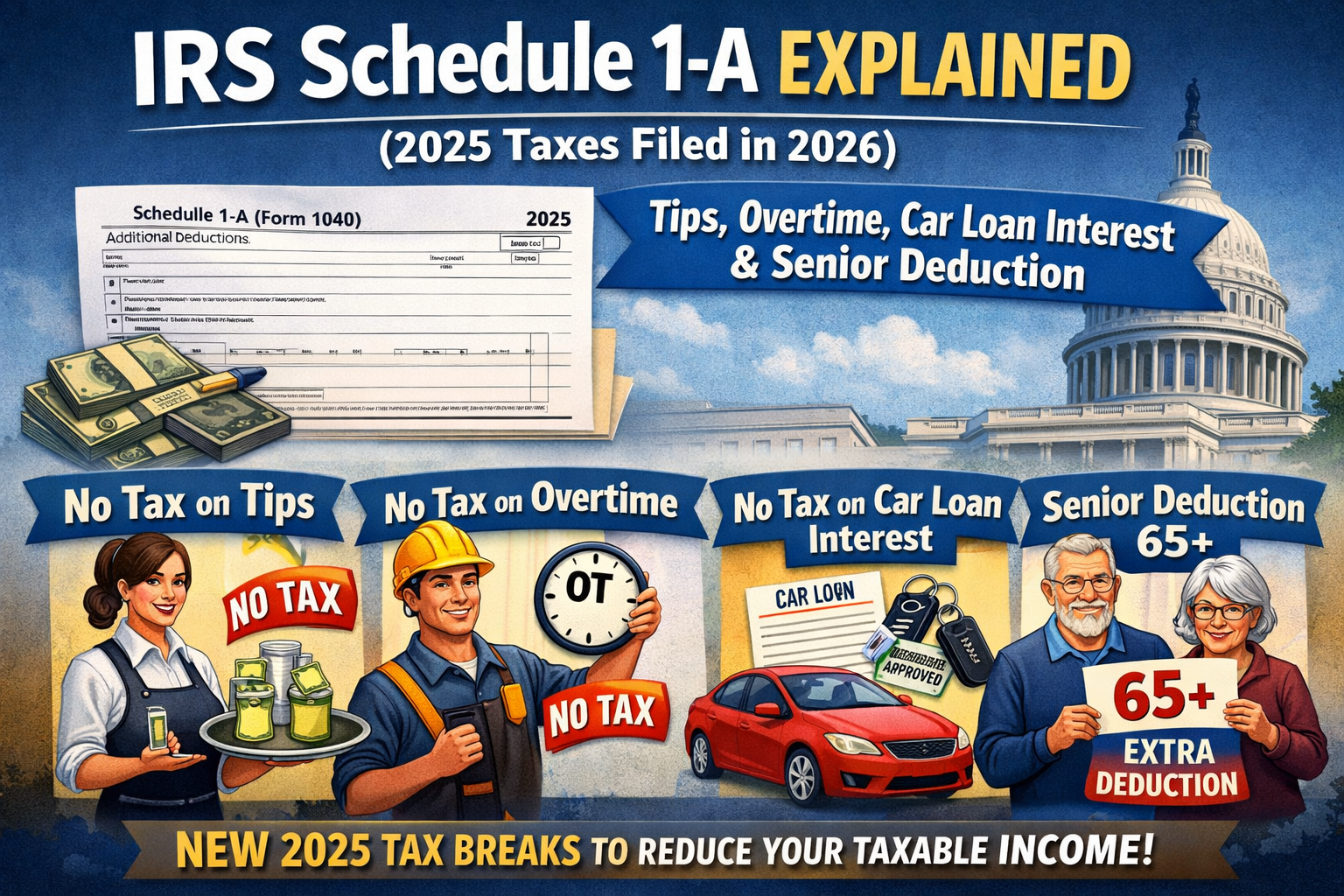

IRS Schedule 1-A Explained (2025 Taxes Filed in 2026): Tips, Overtime, Car Loan Interest, and the Senior Deduction

Schedule 1-A is a brand-new attachment for 2025 federal returns (filed in 2026) that pulls four headline-grabbing tax breaks into one place: tips, overtime, car loan interest, and an enhanced senior deduction. The key thing to know is these benefits generally work as deductions (not “income you don’t report”), and they come with eligibility rules, MAGI phaseouts, and a few easy-to-miss requirements—like separating overtime “premium” pay and reporting a vehicle VIN for the car loan interest deduction. Below is a plain-English guide to what Schedule 1-A does, who qualifies, and what documents to gather now so the deductions are claimed correctly.