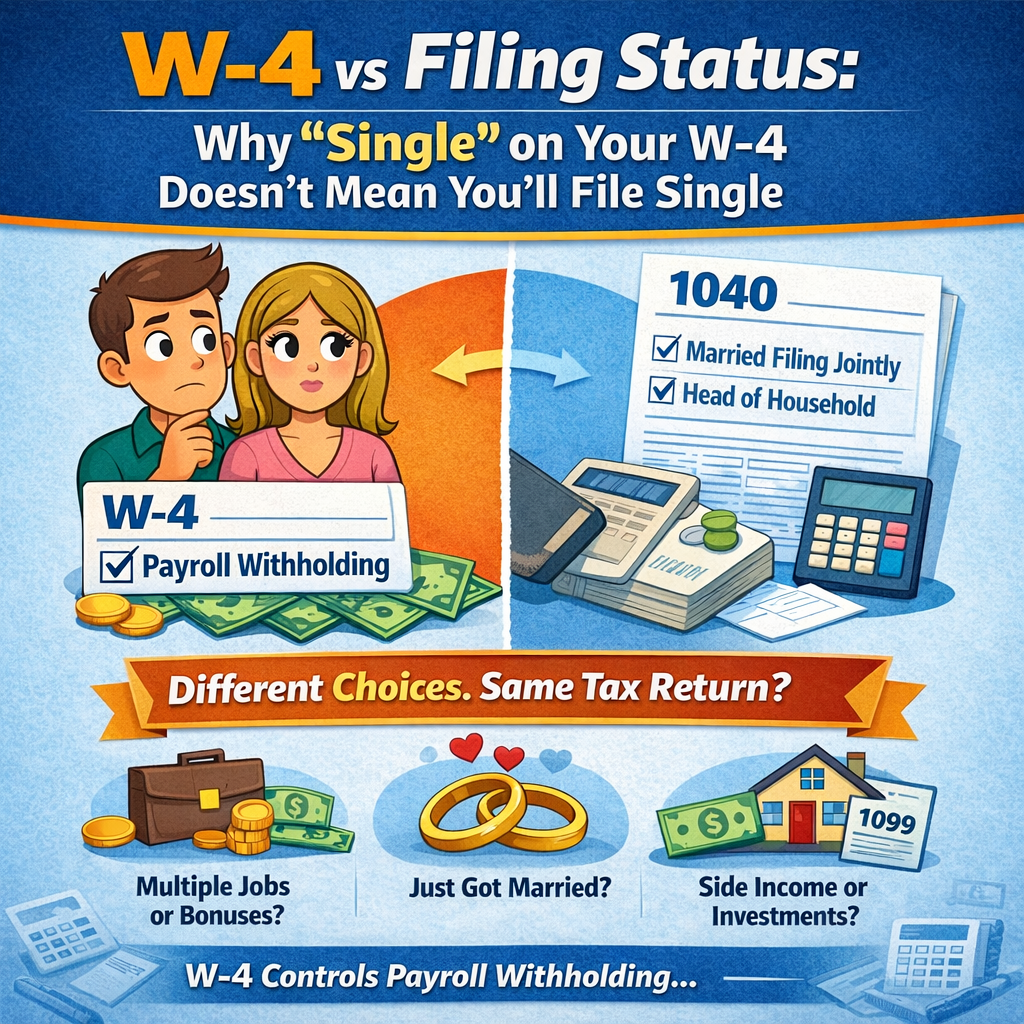

W-4 vs Filing Status: Why “Single” on Your W-4 Doesn’t Mean You’ll File Single

Choosing “Single” on your W-4 doesn’t mean you’ll file your taxes as Single. Your W-4 only controls how much federal tax is withheld from each paycheck, while your filing status is chosen later on your tax return. In this post, we break down why people still end up owing (especially with two incomes, bonuses, job changes, or side income) and share simple, practical ways to adjust your withholding to avoid surprises.

Set Up Your IRS.gov Online Account Now (Before You Really Need It)

Set up your IRS.gov Online Account before you actually need it. When a W-2 is missing, a lender requests transcripts, or an IRS notice shows up, having access already in place can save you days of delays. This guide explains what the IRS Online Account does, how transcripts and digital notices work, why ID.me verification can take longer than expected, and what to have ready so you can get in smoothly.

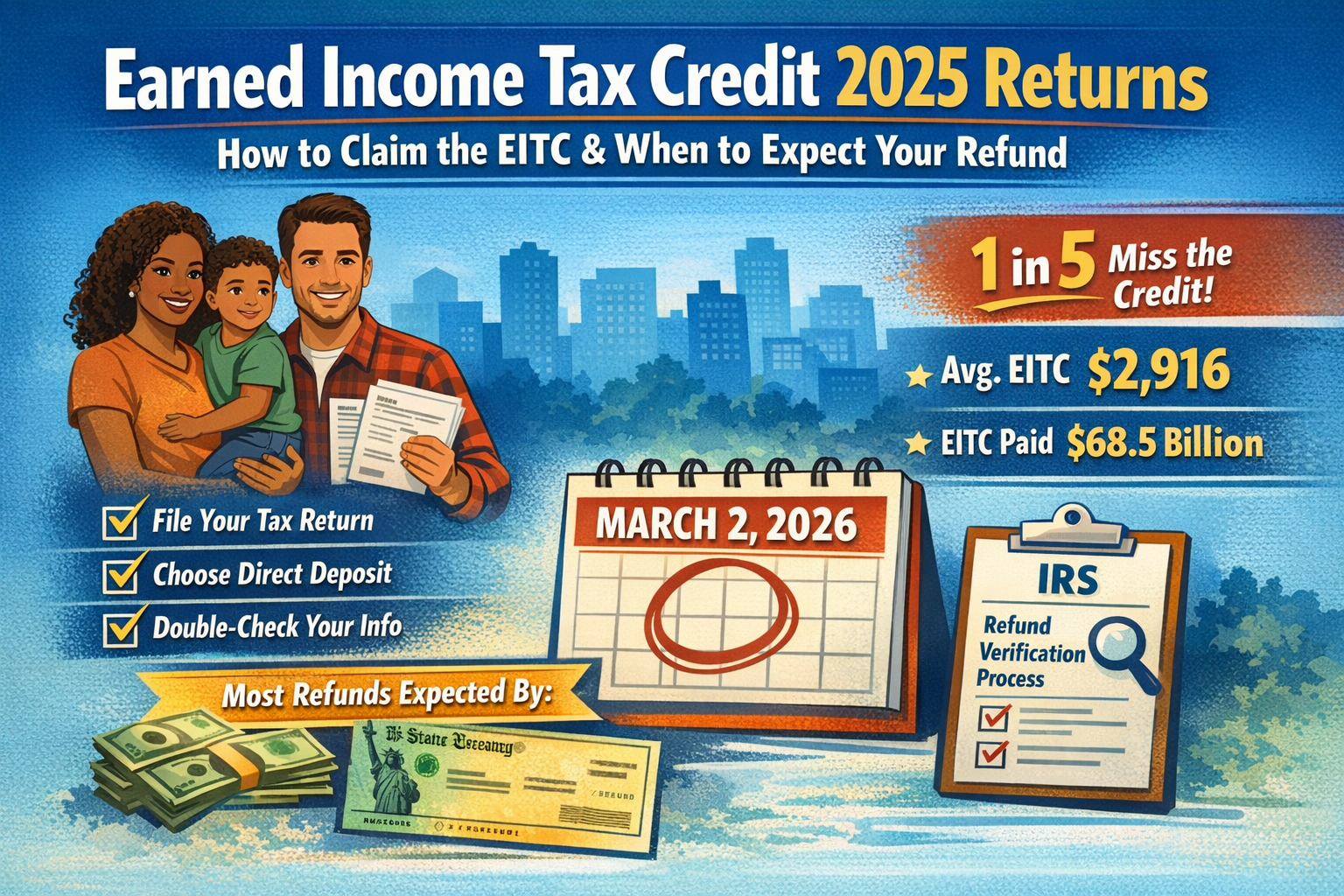

Earned Income Tax Credit for 2025 Returns: How to Claim the EITC and When to Expect Your Refund

Many working families qualify for the Earned Income Tax Credit (EITC) but never claim it, even though it can significantly increase a refund. This article explains, in plain English, what the EITC is, who may be eligible (with or without children), and the practical steps to claim it—like gathering income documents, filing a return even if you’re not required to, and choosing e-file with direct deposit. It also breaks down why EITC refunds are often delayed due to IRS verification rules, and what you can do to reduce avoidable delays caused by common errors. Finally, the post highlights a key timing expectation for many early filers: the IRS projects most EITC refunds will be available by March 2, 2026 (with deposit-date updates showing in Where’s My Refund by Feb. 21, 2026).

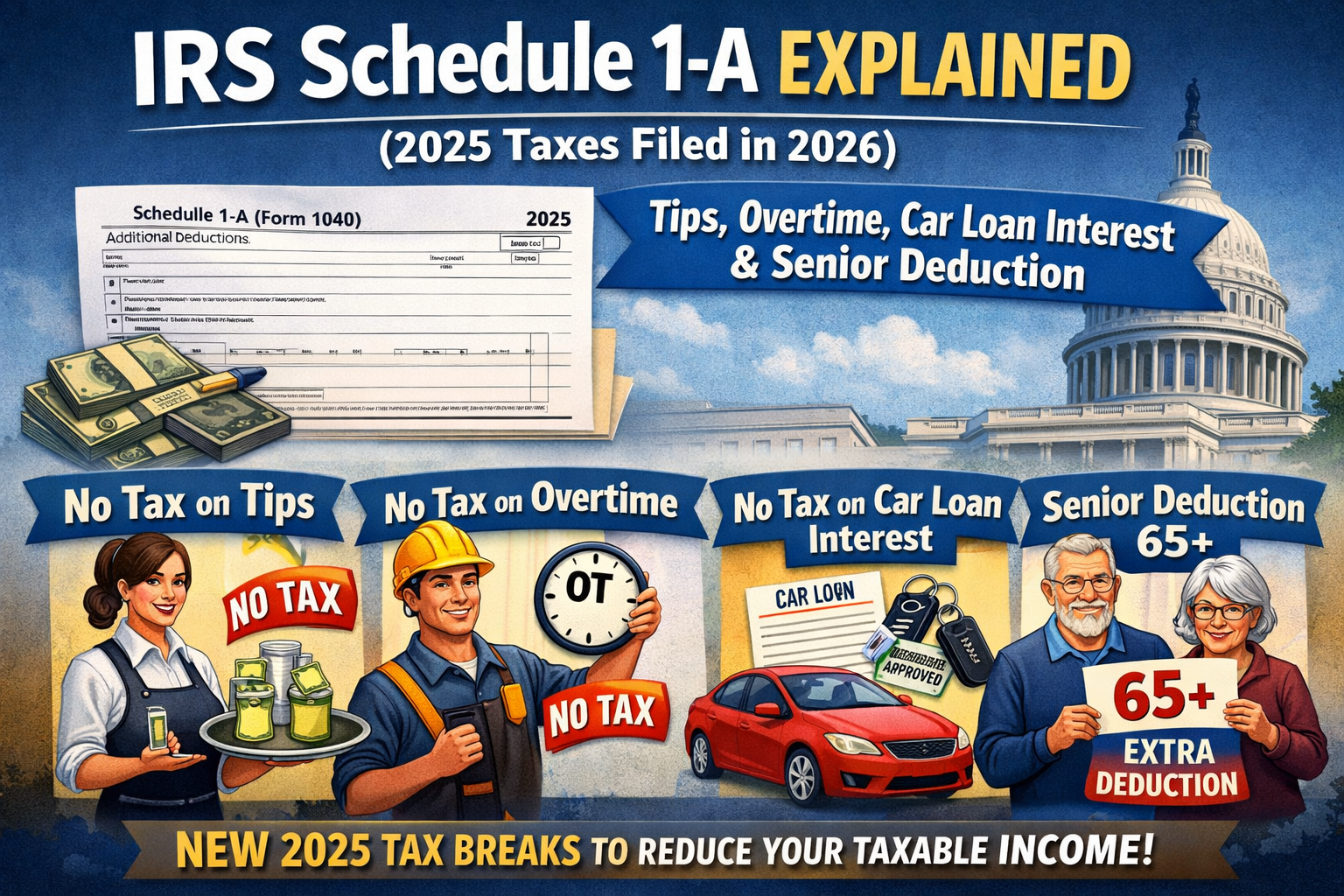

IRS Schedule 1-A Explained (2025 Taxes Filed in 2026): Tips, Overtime, Car Loan Interest, and the Senior Deduction

Schedule 1-A is a brand-new attachment for 2025 federal returns (filed in 2026) that pulls four headline-grabbing tax breaks into one place: tips, overtime, car loan interest, and an enhanced senior deduction. The key thing to know is these benefits generally work as deductions (not “income you don’t report”), and they come with eligibility rules, MAGI phaseouts, and a few easy-to-miss requirements—like separating overtime “premium” pay and reporting a vehicle VIN for the car loan interest deduction. Below is a plain-English guide to what Schedule 1-A does, who qualifies, and what documents to gather now so the deductions are claimed correctly.

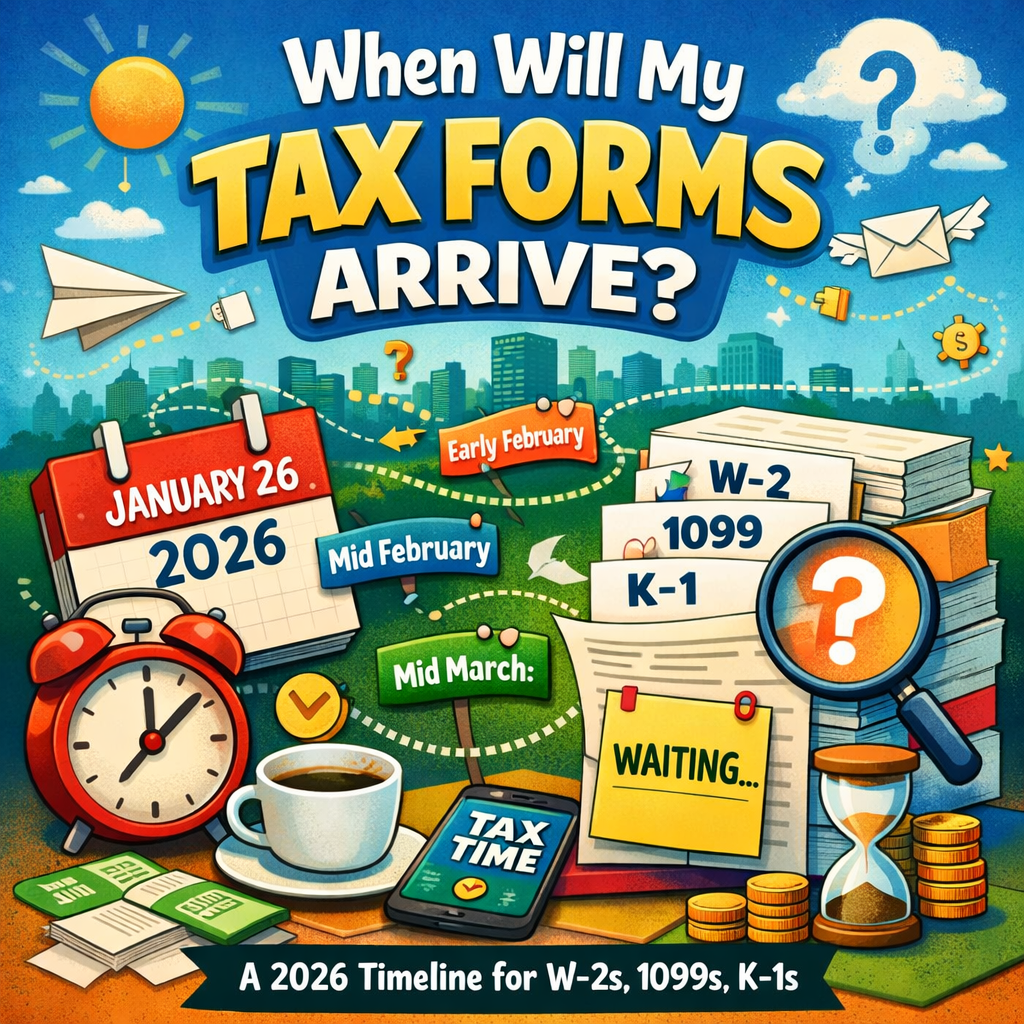

When Will My Tax Forms Arrive? A 2026 Timeline for W-2s, 1099s, K-1s (and What to Do While You Wait)

Waiting on W-2s, 1099s, or a K-1? Use this 2026 timeline to track when tax forms arrive, avoid delays, and file your 2025 return confidently.

Year-End Tax Checklist: How to Prepare for the New Year

Knocking out a few simple steps before the year ends can make tax season dramatically easier. This checklist walks you through setting up one “home” for your tax documents, listing every income source you expect (W-2s, 1099s, side gigs, investments, rentals, or business income), and noting any major life changes—like moving, marriage, a new child, buying/selling a home, or getting a tax notice. If you’re self-employed or run a small business, it also covers a quick year-end bookkeeping cleanup so your records are accurate and ready to file. You’ll finish by gathering common deduction/credit paperwork, planning ahead for withholding or estimated taxes to avoid surprises, and using secure document sharing to protect sensitive information—so you can start the new year organized, confident, and ahead of the rush.